by Ken Lopez

by Ken Lopez

Founder/CEO

A2L Consulting

The tree is up, the 2015 strategic plan is done, holiday travel plans are all set, so it must be time for my annual litigation industry economic outlook for 2015. First though, a reminder of why I do this.

I believe that the litigation industry's performance is closely tied to broader economy's performance. This is especially true for big-ticket cases.

As I have done in 2012, 2013, and earlier this year, I create an economic forecast to both exercise my undergraduate degree in economics a bit and force myself to take a hard look at what the coming year will be like for those of us who focus on litigation for a living.

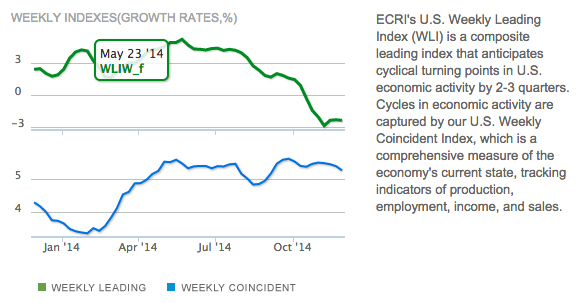

While I can't help paying attention to anecdotal indicators, each year I focus on one leading indicator of economic conditions, ECRI's U.S. Weekly Leading Index. It reliably forecasts economic growth about eight months out into the future.

Big-ticket litigation is largely dominated by large companies who are sophisticated in their monitoring of economic conditions on a day-to-day basis, and it appears that they adjust their litigation spend rather quickly based on changes in the economic climate. When economic conditions are good they file cases, they spend on cases and they tend not to settle cases. When economic conditions are bad or uncertain, they don't file cases with the same fervor, and they do settle cases more quickly.

Truthfully, it's a complicated correlation dollar-wise as it usually takes a couple of good years of economic growth for cases to start being filed in earnest. Since litigation spending increases toward trial, there is also a lag for an upswing on litigation spend.

Anecdotally, we're seeing cases go to trial that might not have made it to trial a couple of years ago and A2L Consulting continues to grow. However, in just the past month we have seen one of the industry's best-known brands, Trial Graphix, be picked apart and sold yet again (is this the fourth time in five years?). It's not easy going in litigation support, but there is growth for those that deliver great value.

Before turning to the forecast, it's worth addressing what gets reported in the popular press. After all, the press keeps saying jobs are growing at the best rate in decades, and all the jobs lost since the beginning of the 2008 recession have been recovered. Well as much as I'd like to get on a bandwagon of optimism, the facts just don't support it - at the very least, the press is cherry picking the good news.

In reality, labor market participation, the percentage of Americans working, is at the lowest number since 1978, the Jimmy Carter years. Furthermore the jobs that are being created tend to be low-wage part-time positions. Wages, the total amount paid to workers in the U.S., are actually down 23% since just 2008.

Now, here's what the forecast says. When looking at the charts below, in the general, up is good and down is bad. The green line is the forecast of economic growth. The blue is what happened in reality.

Here's what this chart says. The blue line tells us that economic growth has been positive for all of 2014 (yes, we did see a GNP dip in Q1 as I discussed earlier this year). The green line, the forecast of the future, tells us something ominous. Up until about June, future economic growth looked slow and steady, but that's when that indicator started falling. It's now negative. That means, beginning in about June + 8 months or so, about February 2015, we can expect to see conditions worsen for the broader economy until at least fall 2015.

Might falling oil prices give the economy a boost? Maybe, but those effects lag at least six months.

Here's the good news. Not many people have spare cash in this economy yet. But you know who does? Big companies do. Corporate profits are at their highest levels since the mid-1960s!

So, while the overall outlook for workers and small and medium sized businesses may not be great, those who focus on servicing the needs of big companies will likely be successful in doing so - if they deliver great value. That is where most of A2L's attention will be in 2015, and that is true for most large law firms.

Articles related to the economics of the litigation market, law firm sales, pricing and more on A2L Consulting's site:

- Mid-2014 Economic Outlook for the Litigation Industry

- 2014 Economic Forecast for the Litigation & Litigation Support Markets

- [Free Download] How to Get Value from Litigation Support Firms in The New Normal Legal Economy

- 2 Metrics Showing Litigation Shifting to Midsize Law Firms

- 8 Reasons to be Optimistic About the Litigation Economy

- 17 Tips for Great Preferred Vendor Programs

- 12 Alternative Fee Arrangements We Use and You Could Too

- Improving Economy Predicted to Bring More and Different Litigation

- 2013: a Good Year for Litigators and Litigation Support Consultants?

Leave a Comment