by Ken Lopez

by Ken Lopez

Founder/CEO

A2L Consulting

Last month the Federal Reserve raised interest rates for the first time in nine years. This action signals that the Fed believes we are entering a period of sustained and significant economic growth. Although the Great Recession officially ended in 2009, for a lot of people, this Fed action may mark the emotional end of it.

Economic conditions do feel considerably better than they did just a few years ago. Most people who want a job can get one now. However, most jobs pay less than they did 10 years ago. Furthermore, a staggering 40% of people over the age of 16 do not have a job. That's the lowest number since the Jimmy Carter years.

So, we can't quite say things are rosy, but we can't say things are terrible either. After all, in 2009, more than 700,000 jobs (including a lot of legal industry jobs) were being lost per month, and now, 250,000 jobs are being added to the economy in a typical month.

What does this all mean for those of us who work in the litigation industry? Will 2016 be a good year? The answer, I believe, is that while it will not be an incredible 2005-like year, it will probably be a little better than 2015, and that's not too bad. Let me support that belief with some additional details.

This is the fourth year I've written an economic forecast for the litigation industry. For 2013, I forecasted improving conditions for all of us, and we saw the economy grow by 2.3%. That was actually a significant improvement over the year before which saw many law firms not growing or even shrinking. For 2014 (also including a mid-year update) and 2015, my forecast was about the same, and so were the results - modest growth.

For law firms and their litigation departments and for litigation support firms like A2L Consulting, these past several years have been growth years. But will it continue? After all, recessions come about once every seven years, and the last recession occurred in 2009.

The last several years have seen only modest economic growth, and there is just not much evidence to suggest that will change. Fortunately, there are no obvious signs of a coming recession in the next year. Worker productivity and corporate profits are both very high, so we can expect the Fortune 500 to continue to perform well. That largely translates into good economic growth numbers, and leading economic indicators support that direction.

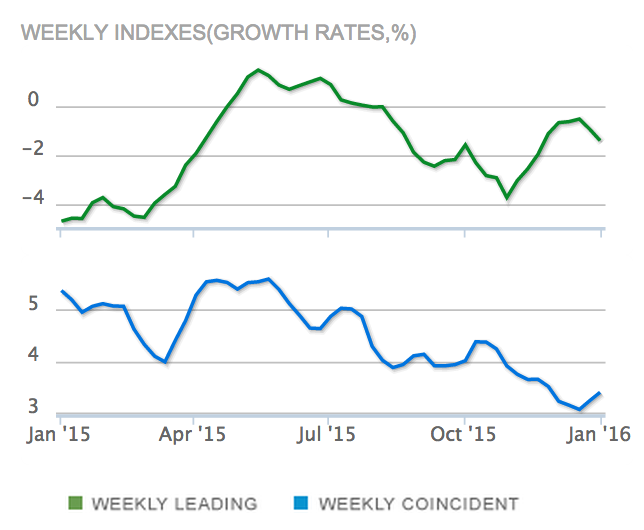

If you've been reading this blog for some time, you know that my forecasts are not conjecture or gut instinct. Rather, they are largely based on what I have found to be the single most reliable economic forecasting tool available, the ECRI Weekly Leading Index.

This index is a composite leading indicator of overall economic conditions looking 6 to 9 months in the future. In my 20 years of running a litigation consulting firm, nothing has proven more reliable, and I use this tool to forecast growth and make decisions about capital investment, hiring, and expansion. In our business, when the ECRI Index is trending up, and the Fortune 500 is doing well, I have a very bullish outlook.

This is true because when the Fortune 500 performs well, so too does big-ticket litigation. When profits are up, Fortune 500 firms are more likely to initiate litigation, risk going to trial, be less likely to settle cases early, and often be willing to outspend their opponent as part of a litigation strategy. For law firms and companies like A2L who spend most of their time around multi-hundred-million-dollar litigation, this translates into another good year ahead. The leading indicators generally support this belief.

To quickly understand this ECRI chart (if it's not mid-January 2016, click to see this week's current version), know that the green line represents a forecast of economic growth about 8 months in the future from the date on the x-axis. When it goes up, that is good. The blue line represents what actually happened at a given point in time in the economy. The blue line shows us that economic growth has been declining since April, but it is not negative. The green line tells us that starting at a point of February 2015 + 8 months (roughly Oct 2015) through the middle of 2016, we can expect to see a return to higher rates of growth. That will be followed by a period of some sustained or slightly less than modest growth.

All of this translates into a pretty good 2016 for most of us in litigation, and I hope to see you in court on the correct side of the "v."

Articles related to the economics of the litigation market, law firm sales, pricing and more on A2L Consulting's site:

- Winning BEFORE Trial - Part 1 - Consider Litigation Costs and Opportunities

- 2015 Economic Forecast for the Litigation & Litigation Support Markets

- [Free Download] How to Get Value from Litigation Support Firms in The New Normal Legal Economy

- 2 Metrics Showing Litigation Shifting to Midsize Law Firms

- 8 Reasons to be Optimistic About the Litigation Economy

- 17 Tips for Great Preferred Vendor Programs

- 12 Alternative Fee Arrangements We Use and You Could Too

- Improving Economy Predicted to Bring More and Different Litigation

- 2013: a Good Year for Litigators and Litigation Support Consultants?

- Headed to trial, IPR, hearing, or ADR in 2016? Please help us not get conflicted out!

Leave a Comment